Deferred retirement option plan calculator

A regular-pay deferred annuity plan that helps you gradually build the retirement savings and provide guaranteed income for life. How do I maximize my employer 401k match.

Sdcers Benefit Estimate Calculator

The plan offers both immediate and deferred annuity options.

. Lets look at an example of doing a FERS Deferred Retirement and an example of a FERS Postponed Retirement. Atal Pension Yojana APY is a deferred pension plan for the unorganized sectors. Flexible premium paying terms and deferment periods.

Flexible premium paying terms and deferment periods. Instead of continuing to add new years of service thereby increasing the employees pension benefit amount the employer will begin placing lump sums into an interest-bearing account annually. Meet your healthcare and lifestyle needs through additional payout options 1.

Contributions to your DCP reduce taxable income in the year of the deferral and can be invested into a selection of investment options. Jane is 55 years old now and she has 9 years of creditable service. Deferred compensation plans are designed for state and municipal workers as well as employees of some tax-exempt organizations.

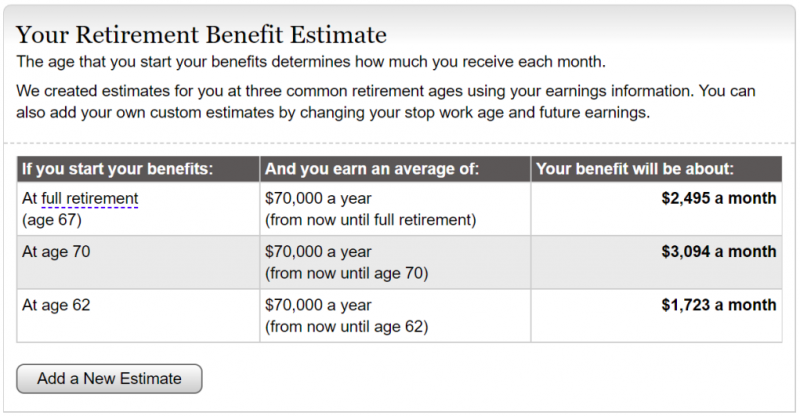

Our Retirement Calculator can help a person plan the financial aspects of retirement. Option 1 Bob Takes MRA10 Retirement Now With Reduced Pension. Professional Case Study.

The Ohio Police Fire Pension Fund OPF is proud to offer this benefit to its membership which has been the most requested addition to OPFs benefit offerings in many years. Participants are allowed to contribute an additional 6500 in the years they turn age 50 or greater for an annual maximum of 27000. For our example well use Jane.

We account for the fact that those age 50 or over can make catch-up contributions. Get all the latest India news ipo bse business news commodity only on Moneycontrol. In the deferred annuity option you pay a lump sum or regularlimited Premium and the annuity payout will start after the deferment period chosen by you at inception.

If you participate in a deferred. What is my projected required minimum distributions. Meet your healthcare and lifestyle needs through additional payout options 1.

This lets us find the most appropriate writer for any type of assignment. 9 Promises from a Badass Essay Writing Service. Annuities are not a common option in 401k plans however.

According to MetLifes 2019 Employee Benefit Trends Study employees ranked a 401k or other retirement plans as the most important company benefit after health and dental insurance with 60. A 457 plan is a type of retirement account offered by nonprofit and governmental organizations. Well assume a historically low 8 average annual return on the stocks and a 4 average annual return on the bonds or a 6 average annual return for the entire portfolio.

We use the current total. What will my qualified plans be worth at retirement. Janes MRA is 56.

Your 1 Best Option for Custom Assignment Service and Extras. A deferred retirement option plan or DROP is a way for an employee who would otherwise be eligible to retire to keep working. Retirement savings plans like 401ks 403bs and IRAs are considered qualified deferred compensation plans.

Deferred Compensation is an opportunity to save and invest dollars on a pre-tax basis similar to your 401k. The content on this page focuses only on governmental 457b retirement plans. Human Resource Development Plan.

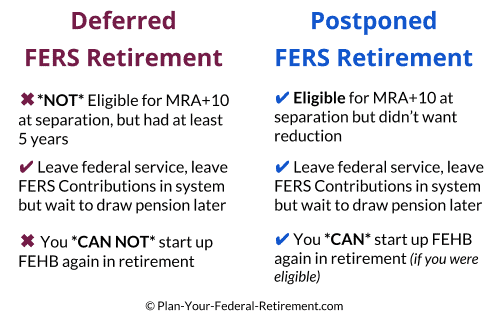

Thank you so much. But you do not have that option with a Deferred Retirement. The Deferred Retirement Option Plan DROP is an optional benefit that allows eligible police officers and firefighters to accumulate a lumpsum of money for retirement.

Deferred annuity with annuity amount guaranteed at Inception. Financial security for your family even in your absence with the Waiver of Premium. If Bob takes an MRA10 FERS Retirement now his FERS pension will be calculated as 100000 x 10 years x 1 10000year.

Unfortunately if you take a deferred retirement you lose access to your health insurance benefits FEHB. What is my current year required minimum distribution. The base maximum contribution is 20500.

A deferred annuity is an insurance contract that generates income for retirement. The Deferred Compensation Plan is only available to Microsoft employees who are Level 67 or higher. To be eligible under this.

This represents the annual allowable of 20500 plus the additional 6500. Deferred annuities are annuities with two phases. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

What are my lump sum distribution options. Not only do you lose out on FEHB with a deferred retirement you also lose out on a FERS supplement. Their portfolio of exactly 1 million is 100 in a traditional tax-deferred retirement account.

Inflation- the big downside of a deferred retirement. The retirement calculator can help plan different ways of retiring. Each calculation can be used individually for quick and simple calculations or in chronological order as a more comprehensive walkthrough of retirement planning.

457f and 457b plans. A regular-pay deferred annuity plan that helps you gradually build the retirement savings and provide guaranteed income for life. Generally if you withdraw money from a 401k before the plans normal retirement age or from an IRA before turning 59 ½ youll pay an additional 10 percent in income tax as a penalty.

Your employer needs to offer a 401k plan. The first phase is the accumulation or. In exchange for one-time or recurring deposits held for at least a year an annuity company provides incremental.

We use the current maximum contributions 18000 in 2015 and 53000 including company contribution and assume these numbers will grow with inflation over time. Qualified deferred compensation plans are tax-deferred pension plans covered by the Employee Retirement Income Security Act of 1974 ERISA. What is the impact of borrowing from my retirement plan.

Examples of FERS Deferred Retirement vs. The Deferred Compensation Plan maximum amounts that can be contributed for is as follows. There are two types.

Assets are allocated precisely 50 stocks and 50 bonds. It has the option of entering existing investments. A deferred compensation plan is another name for a 457b retirement plan or 457 plan for short.

And in a Postponed FERS Retirement you the option to resume your FEHB coverage into retirement. Financial security for your family even in your absence with the Waiver of Premium. The Plan Sponsor Council of Americas 2020 Investment Trends report states that only 163 of retirement plan participants are offered.

I calculated that I would lose at least 1000000 by retiring 1 day before my MRA. One can use this to their advantage by planning various investments in PF or other retirement investment plans.

Drop Deferred Retirement Option Program Retirement Systems

Planning Your Future Retirement Income Acera

Usda Aphis How To Run A Retirement Estimate Using Grb Platform

Sdcers Benefit Estimate Calculator

Florida Retirement System Pension Info Taxes Financial Health

Sdcers 2021 Deferred Retirement Option Plan Drop Interest Rates

Drop Vs Deferred Retirement Pensioncheck Online Fppa

Sdcers Benefit Estimate Calculator

Drop Vs Deferred Retirement Pensioncheck Online Fppa

How Deferred Retirement Option Plans Drops Work

Drop Vs Deferred Retirement Pensioncheck Online Fppa

Fers Deferred Retirement Vs Fers Postponed Retirement

Sdcers Benefit Estimate Calculator

Fers Deferred Retirement What You Need To Know Before You Quit

.png)

Sdcers Benefit Estimate Calculator

Drop Vs Deferred Retirement Pensioncheck Online Fppa

Drop Vs Deferred Retirement Pensioncheck Online Fppa